How to handle your medical bills

Medical bills can quickly become overwhelming, but consumers often have more power than they might think when it comes to navigating them. Recent changes to how medical debt is reported by credit bureaus also help. The first step is always to closely check bills for errors and to ask your provider if you are eligible for any financial assistance programs, which many hospitals offer. If you need additional help, billing advocates and the employee benefits contact at your workplace can also assist. Finally, try to prepare for future bills by building up emergency savings and shopping around for in-network providers.

When she was 19, writer Emily Maloney found herself facing about $50,000 in medical debt after hospital treatment for a mental health crisis. The debt followed her throughout her twenties, hurting her credit and leading to stressful calls from collection agencies.

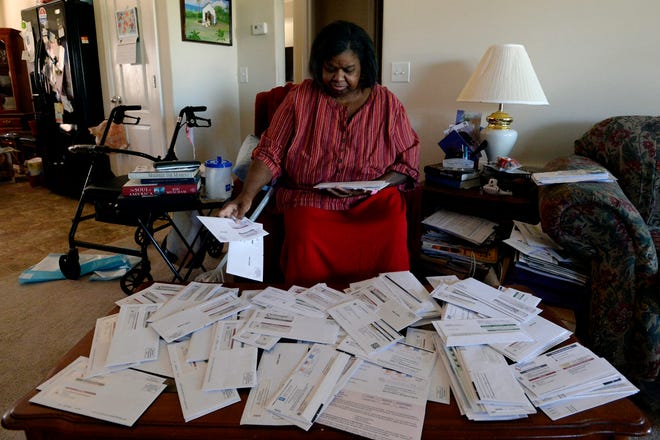

Her experience is all too common: The Consumer Financial Protection Bureau reports that about 1 in 5 U.S. households carries medical debt. People with medical debt are more likely to face anxiety, stress or depression and avoid filling prescriptions because of the cost.

The risk of “medical debt looms over every consumer and impacts their lives,” says John McNamara, assistant director of consumer credit, payments and deposits markets at the CFPB. He adds that recent changes to the way medical debt is reported by credit bureaus should help consumers: Paid medical debts will no longer show up on credit reports and no new medical debt will show up until 12 months have passed (up from six months). In addition, in the first half of next year, the credit bureaus will stop reporting unpaid medical debts under $500.

Eventually, Maloney’s debt was resolved through a combination of a helpful customer service representative and exceeding her state’s statute of limitations. She wrote a book, “Cost of Living,” based on her experiences. She wants to assure others facing medical debt that they can take steps to reduce it.

“It takes time, but you can appeal the insurance company’s decision or ask (the provider) for a discount, so it’s worth a shot,” she says.

In other words, consumers might have more power than they think. Here are some ways to exercise that power over your medical debt.

REVIEW YOUR BILL CLOSELY

It can be tempting to shove a large bill into the trash in frustration. But Dan Weissmann, creator of “An Arm and a Leg,” a podcast about the cost of health care, instead recommends checking closely for errors made by the care provider or insurance company.

“It’s an unfair amount of homework for us to do, because if you find an error, then you have to complain and invest your time, but some medical bills have errors,” he says.

Weissmann says it’s also worth checking your rights under the No Surprises Act, which went into effect in January 2022 and protects consumers from some types of unexpected medical bills.

ASK YOUR PROVIDER FOR ASSISTANCE

Many hospitals offer financial assistance to those who meet income thresholds. “If you get an amount you weren’t expecting, call the hospital and say, ‘Am I eligible for a discount? What is your policy on financial assistance?'” says Richard…

Read More: How to handle your medical bills