What’s Really Going on with Revolving Consumer Credit?

Beyond some of the iffy stuff in the headlines today.

By Wolf Richter for WOLF STREET.

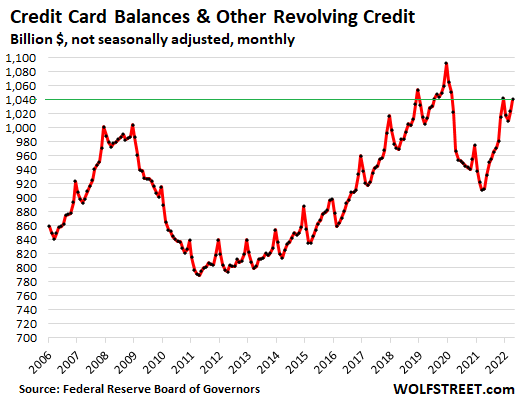

Revolving credit balances in April, not seasonally adjusted – so the actual dollar balances – were $1.04 trillion, according to the Federal Reserve this afternoon. This includes credit card balances, personal loans, etc., and was up by only 2.6% from April 2019.

Let that sink in for a moment: Over a three-year period, revolving credit has grown by only 2.6%, despite 13% CPI inflation over those three years. In other words, the growth in revolving credit has fallen sharply in inflation adjusted terms.

The huge trough between 2019 and today stems from the pandemic when consumers used their stimulus money to pay down credit cards, and when they cut spending on discretionary services, such as sports and entertainment events, international travel, or elective healthcare services such as cosmetic surgery, dentist visits, etc. Over this period, delinquencies dropped to record lows.

Revolving credit balances are barely above the peaks of 2007 and 2008, despite 14 years of population growth and 40% CPI inflation over those years! In other words, revolving credit just isn’t the kind of issue it was in 2008. It’s a sideshow.

In terms of growth – in terms of additional borrowed money spent in the economy – it was minuscule. There was in fact no growth since December. And after the pay-downs in January and February, following the annual holiday shopping binge, the total balances only grew by $14 billion in March and by $17 billion April, for a combined $31 billion.

This growth of $31 billion in March and April didn’t even make up for the $32 billion in pay-downs in January and February. These are actual dollars, not seasonally adjusted theoretical dollars.

In terms of adding to the growth of the economy: Total consumer spending is currently running at an annual rate of $17 trillion, with a T. So how much growth would the additional spending from the increase in revolving credit add? That was a rhetorical question. It’s minuscule.

Since 2019, consumer spending has increased 19%, and revolving credit has increased only 2.9%, both not adjusted for 13% inflation over the period. In other words, growth in revolving credit fell sharply behind inflation and fell massively behind growth in consumer spending.

This shows that consumers are relying less on revolving credit.

Credit cards and some types of personal loans, such as payday loans, are the most expensive form of credit, and they often come with usurious interest rates. Credit card rates can exceed 30%. And Americans have figured this out. If they need to fund purchases, many consumers use cheaper loans, including cash-out refinancing of their mortgages.

And many, many consumers are using their credit cards just as payment methods, and they pay them off every month. That’s what these relatively low balances show.

The beautiful seasonal adjustments.

The seasonal adjustments to the actual revolving credit dollar balances are designed to match up with the peak month every year, namely December. In other words, there are no seasonal adjustments for December, but the other 11 months are always…

Read More: What’s Really Going on with Revolving Consumer Credit?