Shareholders in Hongkong and Shanghai Hotels (HKG:45) have lost 36%, as stock

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that’s been the case for longer term The Hongkong and Shanghai Hotels, Limited (HKG:45) shareholders, since the share price is down 38% in the last three years, falling well short of the market return of around 16%.

With the stock having lost 4.2% in the past week, it’s worth taking a look at business performance and seeing if there’s any red flags.

Check out our latest analysis for Hongkong and Shanghai Hotels

Hongkong and Shanghai Hotels isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn’t make profits, we’d generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

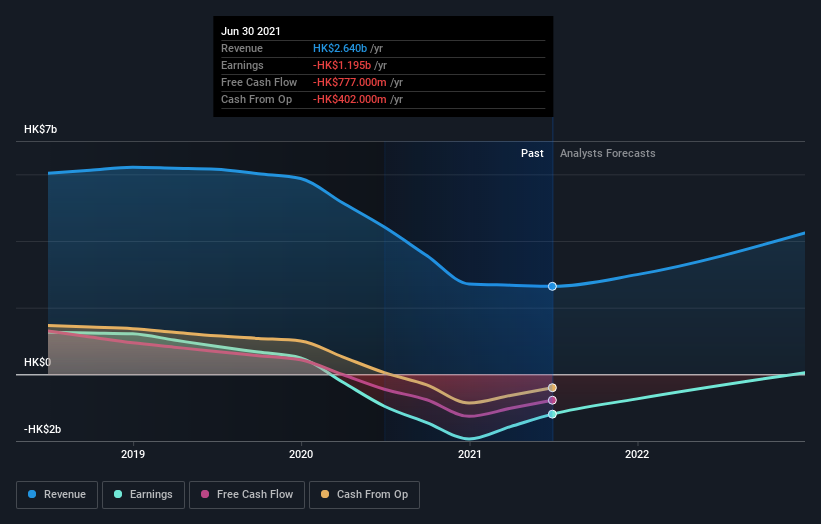

In the last three years Hongkong and Shanghai Hotels saw its revenue shrink by 29% per year. That’s definitely a weaker result than most pre-profit companies report. On the face of it we’d posit the share price fall of 11% compound, over three years is well justified by the fundamental deterioration. It would probably be worth asking whether the company can fund itself to profitability. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We’d be remiss not to mention the difference between Hongkong and Shanghai Hotels’ total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Hongkong and Shanghai Hotels’ TSR of was a loss of 36% for the 3 years. That wasn’t as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Hongkong and Shanghai Hotels shareholders are down 5.3% for the year. Unfortunately, that’s worse than the broader market decline of 4.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there’s a good opportunity. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of…

Read More: Shareholders in Hongkong and Shanghai Hotels (HKG:45) have lost 36%, as stock