Fed warns of rising risky asset prices, as stocks and bitcoin hit record highs –

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

The surge in risky asset prices this year has made them increasingly susceptible to a tumble if economic growth takes a turn for the worse, the pandemic escalates, or investors lose confidence.

That’s the message from the US Federal Reserve, which is also concerned about the rise of stablecoins which underpin the cryptocurrency market.

In its latest financial stability report, the Fed flagged that prices of risky assets have generally risen further since its previous report six months ago.

Despite concerns about the spread of the Delta variant of the virus that causes COVID-19, asset prices have been supported by increased earnings expectations and low Treasury yields, it says.

In a warning to the markets, they say:

Prices of risky assets generally increased since the previous report, and, in some markets, prices are high compared with expected cash flows. House prices have increased rapidly since May, continuing to outstrip increases in rent. Nevertheless, despite rising housing valuations, little evidence exists of deteriorating credit standards or highly leveraged investment activity in the housing market.

Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall.

But are investors heeding the message?

Last night, the US stock market closed at a fresh record high, extending its pandemic rally, as investors continue to shrug off concerns about rising inflation, supply chain problems, and the ongoing pandemic.

Ryan Detrick, CMT

(@RyanDetrick)The S&P 500 has made a new all-time high the first 6 trading days of November.

This is the longest all-time high streak to start any month since 6 in January 2018.

In fact, only once in history has a month started off with 7 consecutive all-time highs and it was July 1964.

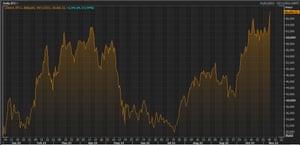

And bitcoin has struck a new record high this morning — hitting $68,550 for the first time, as crypto assets continue to surge.

Critics would point out that the Fed’s own policies have helped drive the rally in risky assets.

Since early in the pandemic it has kept interest rates at record lows and pumped $120bn per month into the system through its bond-buying stimulus programme, which it is just starting to wind down.

The Fed’s financial stability report shows concerns over the rise of stablecoins – cryptocurrencies [such as tether] that try to peg their market value to some external reference, such as the US dollar.

The Fed points out that the sector has grown fast, and warns that ‘some stablecoins are vulnerable’

Policymakers are concerned about the consequences if a stablecoin can’t hold its value.

The value of stablecoins outstanding has grown about fivefold over the…

Read More: Fed warns of rising risky asset prices, as stocks and bitcoin hit record highs –