Europe’s recovery hits ‘sweet spot’ but economists see risks gathering

Europe’s economy is roaring back from the coronavirus crisis. Growth in the euro area outpaced both the US and China in the last quarter, more than 70 per cent of EU adults have been fully vaccinated against Covid-19, investment is booming and unemployment is falling.

However, European Central Bank president Christine Lagarde sounded a cautious note last week, saying “we are not out of the woods” and highlighting a number of risks over the coming months, despite raising its growth forecasts for the third consecutive time this year.

Economists say the European economy is in the “sweet spot” of its bounceback from the record postwar recession caused by the pandemic last year. But they warn the region looks set to follow the pattern seen in the US and China, which recovered faster from the Covid-19 crisis only for their rebounds to lose momentum more recently.

“We will get a good third-quarter growth number for the eurozone, but the winter brings the risk of a slowdown,” said Erik Nielsen, chief economist at UniCredit. “Our leading indicator is nosediving into the end of the year, so there are warning signs this recovery may not be as smooth as people think.”

The biggest warning sign is coming from bottlenecks in the global supply chain that have left manufacturers grappling with shortages and soaring prices of everything from semiconductors and paper to steel and plastics.

Executives at carmakers lined up at last week’s IAA Mobility conference in Munich to warn that there was no end in sight for the chip shortage that has forced them to shut production lines and left their output 30 per cent below pre-pandemic levels. “I believe the third quarter will be the trough, and then we will start moving back up again in the fourth quarter,” said Ola Kallenius, Daimler’s chief executive.

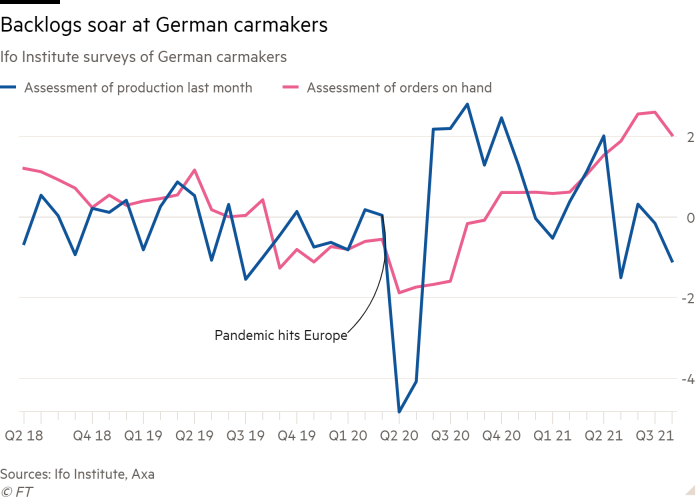

“The supply side issues are definitely a problem,” said Gilles Moec, chief economist at Axa. “Just look at the gap between orders and output at German carmakers, it is massive, and a good chunk of demand is not being filled so we are missing some output.”

Moec added that supply chain problems could hit consumer spending if they fuelled higher eurozone inflation, which already rose to a decade-long high of 3 per cent in August and is expected to keep rising for several more months. “We are starting to see that affect consumers in the US and it could happen here in Europe too,” he said.

The second risk for Europe’s recovery is if the Delta variant or another strain causes a further damaging wave of Covid-19 infections, despite rising vaccination levels.

“The spread of the Delta variant has so far not required lockdown measures to be reimposed,” Lagarde said. “But it could slow the recovery in global trade and the full reopening of the economy.”

The number of coronavirus patients in intensive care in Germany doubled in the past fortnight, though it is still well below previous peaks. In France, the Pasteur Institute warned last week that lifting all remaining restrictions would “lead to significant stress on the health system”, with more than 5,000 hospitalisations a day — more than at the peak of the…

Read More: Europe’s recovery hits ‘sweet spot’ but economists see risks gathering