Weekend Long Read: What Does China’s Consumption Slowdown Mean for the Economy?

China wants to boost its “dual-circulation” strategy, with emphasis on both internal and external circulation. However, the internal economic circulation is likely to have slowed down at the beginning of the second half of 2021.

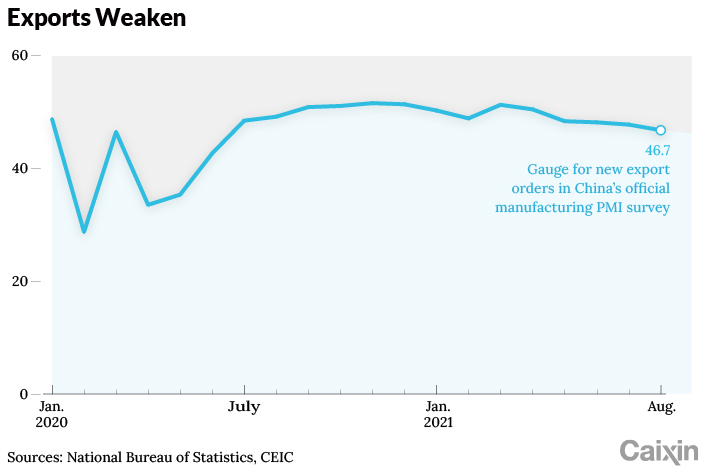

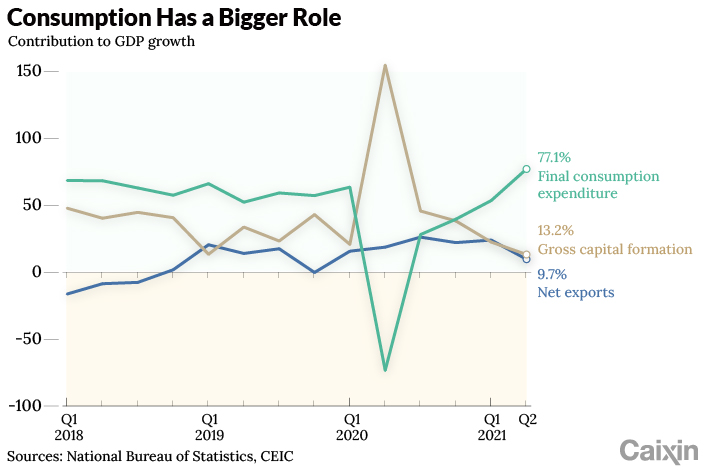

Over the past seven months, unadjusted fixed-asset investment declined year-on-year. The export growth rate slowed, but the manufacturing growth was still mainly driven by exports. The rapid decline in investment and exports pushed the contribution of consumption to China’s GDP to 77%.

|

Although consumption has a significant role to play in internal economic circulation, its growth rate is seeing a notable decline and some structural problems are emerging. The growth in monthly retail sales of consumer goods is showing a downward trend. In July, the annual growth rate of the retail sales of consumer goods was only 8.5%, a big drop from 12.1% in June.

At the first glance, consumption expenditure seems to be affected by the pandemic prevention and control measures. But a deeper scrutiny reveals that a drop in the growth of individual income, gloomy economic forecasts and diminishing marginal propensity to consume are the underlying causes for the slowdown. If effective measures are not taken to stimulate consumption as soon as possible, China will face the challenge of an economic slowdown in the second half of 2021 and even next year. Meanwhile, it will seriously impede the country’s plan to establish “a new development pattern of dual circulation, in which domestic and foreign markets reinforce each other, with the domestic market as the mainstay.”

|

Slowdown in consumption expenditure

According to data from the National Bureau of Statistics, the retail sales of consumer goods grew by 20.7% year-on-year from January to July, with an average two-year growth rate of 4.3%. But if we compare it with recent data, the results do not look very optimistic.

From January to July, 2019, before the pandemic, the total retail sales of consumer goods reached 22.83 trillion yuan ($3.5 trillion), a year-on-year growth of 8%. If extrapolated, the figure for 2020 (without the impact of the pandemic) would be 24.65 trillion yuan. However, the retail sales of consumer goods in the first seven months of 2021 stood at 24.68 trillion yuan, similar to the extrapolated figure for 2020. It means that the current retail sales of consumer goods have recovered to what they would have been in 2020, if there was no pandemic.

As for the national per capita consumption expenditure, the average two-year growth rate is 3.2%, which is two percentage points lower than the actual growth rate in the first half of 2019.

Although the data on retail sales of consumer goods and national per capita consumption expenditure both show that China’s consumption growth has just returned to what was expected in 2020, the consumption expenditure in the second quarter of 2021 rose to 77.1% of the GDP from 53.5% in the first quarter. Notably, such a rise was not realized by strong consumption growth but was caused by a decline in investment and exports.

As for investment, the national fixed-asset investment (excluding…

Read More: Weekend Long Read: What Does China’s Consumption Slowdown Mean for the Economy?